What is QuickBooks Payroll?

QuickBooks Payroll one of the most well-known accounting software platforms available, offers business owners a variety of services. In addition to offering powerful accounting solutions, QuickBooks also provides payroll services to help business owners handle payroll more easily. One of the most crucial aspects of HR for a small business is employee pay, and QuickBooks may seem like the obvious solution for your payroll requirements.

The purpose of payroll software is to make it simple and quick for you to pay your employees, thus saving you time and, ideally, money. However, is QuickBooks Online Payroll the best programme for your company? Let us guide your decision. The features, costs, benefits, and drawbacks of utilising QuickBooks Payroll will all be discussed in this study. We’ll also go through the finest alternatives to QuickBooks Payroll so you can choose the solution that best suits your requirements.

Overview

Payroll software like QuickBooks Online Payroll lets you figure out your payroll, pay your employees, and prepare and submit your business taxes. Do not mistake it for the QuickBooks Desktop Payroll programme. As you might anticipate, a QuickBooks subscription may directly operate with QuickBooks Online Payroll, and QuickBooks provides bundle subscriptions for the two services. However, you may also buy QuickBooks Payroll independently and utilise it on its own without using the QuickBooks Online accounting programme.

| Same-day direct deposit | An HR support center | An HR support center |

| Customizable user permissions | Payroll setup review from a QuickBooks expert | An HR support center |

Pros

- Easy-to-use interface

- Cloud-based

- Payroll tax help

Cons

- More expensive compared to other options

- Lack of integrations

Features

Your precise features will ultimately rely on which of the three plans you select if you use QuickBooks Online Payroll. Overall, though, you’ll be able to set up and manage your payroll with any QuickBooks Payroll plan. Direct deposit (or a paper cheque) will be an option for paying both your employees and contractors. You can submit payroll up until 5 p.m. the day before payday thanks to QuickBooks Payroll’s 24-hour direct deposit feature. You can manage and review your payroll online or on the go with the QuickBooks mobile app.

The extent of your features, as we have discussed, is what distinguishes the three QuickBooks Payroll plans from one another. Although all three plans will provide the features we’ve just discussed, the two top-tier plans, Premium and Elite, will provide even more features above and beyond those of the Core plan.

With the Premium plan, you’ll have access to:

- Same-day direct deposit

- Customizable user permissions

- An HR support center

- Payroll setup review from a QuickBooks expert

- TSheets, the QuickBooks time tracking tool, is accessible on mobile devices and offers premium time monitoring.

The Elite plan will have the greatest capability and the most support from QuickBooks because it is the highest-level option. You will get everything from the two earlier plans, plus the following, with this one:

- Professional payroll setup

- Exceptional timekeeping with geofencing and project management

- Tax penalty-free guarantee

- U.S.-based payroll support via phone or chat

- Personal HR advisor

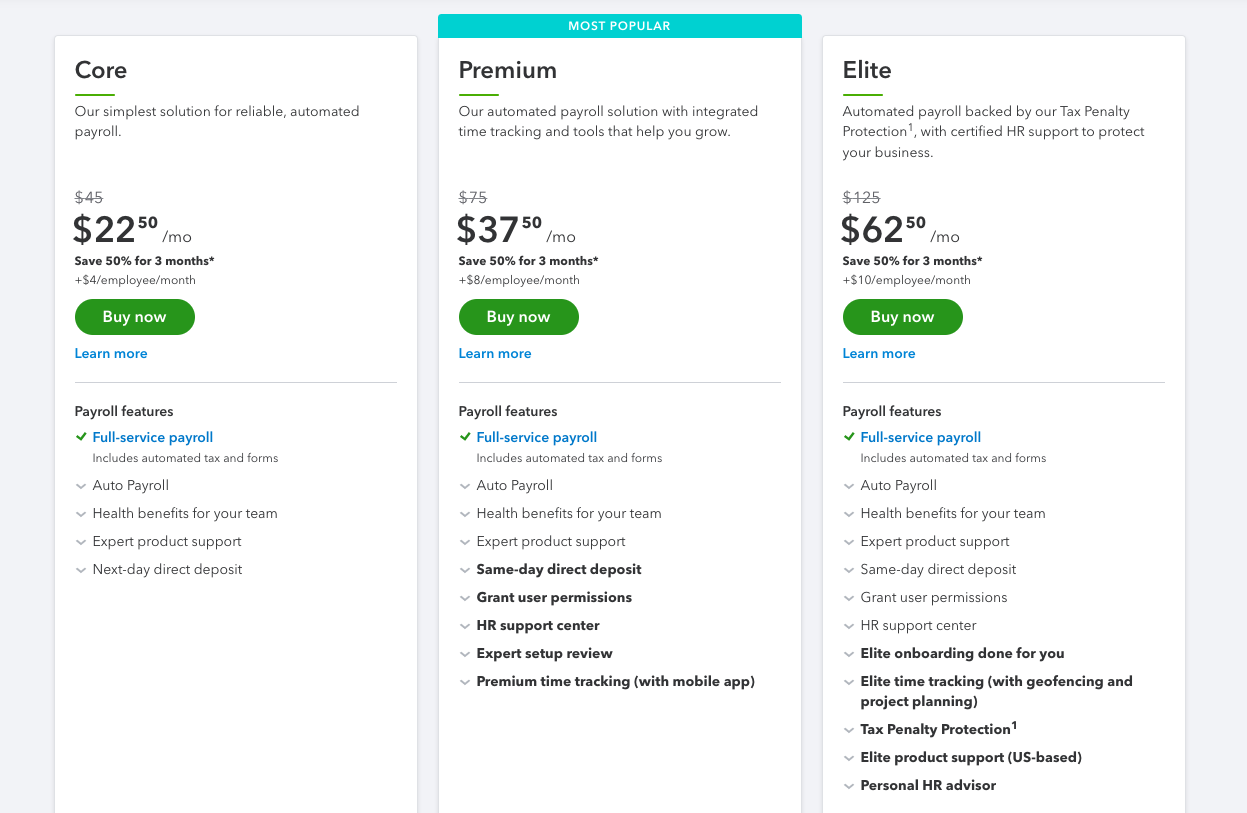

Image source: QuickBooks

In addition, if you decide to use QuickBooks Payroll as a component of a QuickBooks Online subscription, you also get access to all the subscription’s features, including its third-party integration options, in addition to your payroll services. You can sync your data between the two platforms if you utilise both QuickBooks Payroll and QuickBooks Online accounting software. Therefore, it’s crucial to be aware that QuickBooks Payroll does not provide third-party connectors outside of the QuickBooks software. If you use another accounting programme, you will therefore need to manually enter or transfer your data between platforms.

Pricing

QuickBooks Payroll Pricing is subscription-based, comprising a monthly fee in addition to a monthly charge for each employee, like many other payroll software options. The Core Plan is priced at $45 per month plus $4 for each employee. The Premium plan, on the other hand, has a monthly cost of $75 + $8 for each employee. Finally, the Elite plan is priced at $125 per month + $10 for each employee.

Additionally, you can benefit from QuickBooks bundle price offers if you choose to use QuickBooks Payroll as an add-on to your QuickBooks Online membership. Since QuickBooks Online frequently has sales, you could be able to get their services for up to 50% off for the first three months. Free trials are also available. Furthermore, there is no contract or obligation while using any of these QuickBooks packages. Without incurring a price, you can change your mind or cancel at any moment.

QuickBooks Payroll Pros

There are obviously benefits to selecting QuickBooks Payroll for your company since it is one of the most well-known names in business management software. Here are three benefits:

Integration With QuickBooks

The connection between QuickBooks Payroll and the accounting programme QuickBooks Online may be its biggest benefit. If you already use QuickBooks Online, all you have to do to start automating your payroll process is to add either of the QuickBooks Payroll plans to your existing subscription. This will enable you to set up payroll and easily integrate it with all of your existing data in QuickBooks Online.

You and your team members will be able to manage taxes, conduct payroll more quickly and conveniently, and keep track of these duties with your accounting requirements thanks to this integration, effectively streamlining your company operations. In fact, a lot of the favourable evaluations of QuickBooks Payroll emphasise how you may utilise it in conjunction with QuickBooks Online to streamline your procedures. You have a strong reason to take advantage of the QuickBooks pricing offers if you don’t already have QuickBooks Online and want accounting software and payroll services.

Payroll Taxes

Another huge pro of QuickBooks Online Payroll is that they help you with your payroll taxes. QuickBooks can calculate your federal and state payroll taxes automatically. If you were concerned that there might be problems in those payroll taxes, you can also choose QuickBooks’ Tax Penalty Protection, which guarantees that if there are any errors in the filings, QuickBooks will fix them and pay any ensuing fines on your behalf.

Usability

QuickBooks is one of the most popular accounting software options out there and has been serving small business owners for decades. It’s a tried-and-true software and this familiarity extends to their payroll offering. By all accounts, QuickBooks Payroll is simple to use and understand. This software, like QuickBooks itself, is designed to be used by anyone, regardless of education or experience. With the direct connection between QuickBooks Payroll and QuickBooks Online, this payroll software is going to be even easier to use if you have any experience with QuickBooks.

And again, since QuickBooks is such a big player in small business services, the resources available to help you through your process are endless. If you use the Elite plan, you have U.S.-based customer support included in your plan. However, even if you only utilise the Core package, you can still access all of the online tools on the QuickBooks website and the many experts who are available. have experience with this software suite.

QuickBooks Payroll Cons

Although there are unquestionably advantages to adopting QuickBooks Payroll, there are also drawbacks to take into account. Here are a few:

Limited Extended Features and Integration Options

Even though QuickBooks has added capabilities to its payroll product compared to past editions, it still lacks some advanced capability, especially if you don’t choose a premium plan or use the programme as part of a QuickBooks Online subscription.

Despite the fact that QuickBooks Payroll’s Core package provides services like benefits administration, you must choose Premium or Elite to get access to extra HR capabilities like the HR help centre or time tracking. In a similar vein, QuickBooks Payroll does not provide some of the hiring, onboarding, and employee-focused options found in some of the competing payroll software products, such as Gusto or Justworks.Therefore, if you’re truly looking for a payroll and HR software in one platform, there are definitely more comprehensive (and cost-effective) options to consider.

Additionally, you are limited to using only products from the QuickBooks suite if you do not use QuickBooks Payroll in conjunction with a QuickBooks Online subscription. Therefore, if you don’t use QuickBooks as your accounting software, you would have to manually move and monitor data between your accounting and payroll platforms. This also limits your HR capabilities, as many other payroll software platforms give you the ability to use HR add-ons or integrate with other software to expand your functionality. The QuickBooks Payroll interface with QuickBooks Online is helpful if you intend to use (or already have) that accounting programme, but it may be difficult and constricting if you don’t.

Price

Despite the deals available to you if you purchase QuickBooks Payroll as part of a QuickBooks Online subscription, the general cost of the three QuickBooks Payroll plans isn’t as impressive when compared to other payroll software (and their functionality). For instance, Patriot Payroll has a Full-Service Payroll plan with nearly identical features to the QuickBooks Core plan. However, their programme is $30 per month plus $4 per month for each employee. Moreover, for comparison’s sake, Patriot also offers you add-on capabilities for their HR software and time and attendance tools at very low additional fees.

As you might anticipate, a QuickBooks subscription and QuickBooks Online Payroll can be used together directly, and QuickBooks provides bundle options for these two services.

Follow Us On LinkedIn